A Year of $PRIME on Teller

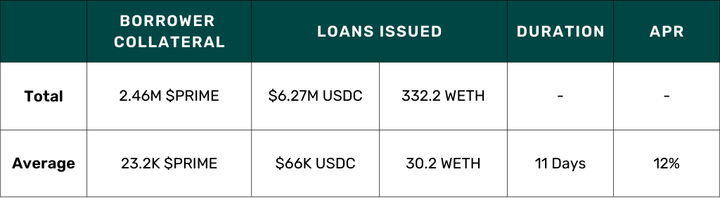

$PRIME Loans in Numbers

August 23rd, 2023 marked the first $PRIME loan issued using the Teller protocol. Since then, borrowers have initiated 100+ loans with $PRIME as collateral— totaling $7.4M+ in loan volume .

Why the need?

Holders of $PRIME tend to use liquidity on Teller like a cash advance. If an active position is close to liquidation, or a new yield opportunity arises, borrowers tap into liquidity without the risk of price-based liquidation.

Teller is built with time-based loans. Repay on time, receive collateral back.

Here are some of the memorable $PRIME loans with Teller:

1. First $PRIME Loan

The very first $PRIME loan was issued on August 23, 2023. 26K $PRIME was used as collateral for a 24K $USDC loan. Loan duration was 7 days at an APR of 25% and was fully repaid with 25K $USDC.

2. $PRIME Whale

On April 29, 2024 one of the top-100 holders of $PRIME borrowed 154 WETH against 100K $PRIME collateral. Terms of the loan are 40% APR over 30 days, with payment of 159 WETH due May 29.

3. The Borrowooor

Between March 7 and April 29, 2024, one user borrowed against their $PRIME to access loans in USDC as well as WETH. Using 200k $PRIME as collateral, they received a total of 286 WETH & 212K $USDC. The loans had an average APR of 33%.

$PRIME loans issued using the Teller protocol 💰

How do loan repayments work?

When a $PRIME loan is repaid, the borrower receives their collateral back. If the borrower is not ready to pay when the loan is due, they can roll it over into a new loan, or increase collateral for any loan with an open liquidity provider offer. 96% of $PRIME loans have been paid in full .

What about liquidity?

$PRIME loans provide access to over $1.3 million in liquidity for both USDC & WETH. Loans are available for periods of 12 hours to 120 days, and APRs range from 9% to 30% .

How to access a loan?

To access a cash advance using $PRIME as collateral, or to provide liquidity and earn yield, visit Teller.