4 Ways to Use a Teller Time-Based Loan

Teller enables time-based, DeFi loans, allowing any asset on Ethereum Mainnet, Polygon, Base, and Arbitrum as collateral.

Traditional DeFi lending relies on oracles to track collateral value and, often, comes with the risk of margin calls. Teller loans are based purely on duration. Once a borrower secures a loan, the borrower's collateral is safe from liquidation due to price fluctuations—borrower’s only responsibility is to repay or extend the loan within the agreed timeframe.

This approach makes Teller an ideal solution for DeFi users who need access to liquidity, without the worry of market volatility.

Below are four practical ways a user may utilize a Teller time-based loan.

Saving the Health Ratio of a Leveraged Position

Leverage can amplify gains, but it also comes with increased risk. A sudden market dip can put a leveraged position at risk of liquidation, especially when traditional loans rely on oracles and margin calls to determine collateral value.

Teller time-based loans do not have margin calls and oracles. Borrowers are not at risk of sudden liquidation due to market fluctuations. This allows borrowers to improve the health of their open long position, during market dips, without fear of liquidation during volatile price movements. Instead, borrowers have the flexibility to manage their positions, with a fixed repayment timeline, ensuring enhanced trade stability and the ability to recover as the market recovers.

Example: Consider a trader who has leveraged a position on Ethereum, and a sudden downturn puts that position at risk. With a Teller loan, the trader could quickly borrow stablecoins to reinforce the collateral, avoiding liquidation and allowing the position to be maintained until the market rebounds.

TLDR; the health ratio of an open position can be improved with a Teller loan. Learn how time-based loans can enhance a trade.

Borrowing Against One Token to Buy Another

The DeFi market is known for frequent, and time sensitive, opportunities. Sometimes, an opportunity may arise to acquire a token for its utility. Teller enables users to borrow against ANY tokenized asset on supported chains. The result: retention of existing tokens, while taking advantage of new opportunities in the DeFi market

Example: Consider a scenario involving the memecoin $APU. Instead of selling $APU, borrowers can utilize Teller’s time-based loans to secure liquidity, without parting ways with their tokens.

In June, one borrower used 422.11 million $APU as collateral to obtain 68.3k USDC for a 3-day loan! The borrower was able to quickly access liquidity, while maintaining their $APU position. By using Teller's time-based loan, they could capitalize on market opportunities without disrupting their existing investments.

TLDR; Teller loans have been used to maximize liquidity from memecoins like $APU. Check out the blog on borrowing against memecoins.

Points/Yield Farming

Yield farming emerged as a popular strategy in DeFi. However, participating in these opportunities often demands substantial liquid capital; a challenge for those holding long-term assets.

With a Teller time-based loan, users can access the liquidity needed to enter yield farming pools, without the need to sell off valuable holdings. Teller loans allow borrowers to renew their loans as needed via rollover. This flexibility extends the repayment timeline, ensuring participants can maximize their engagement in points or yield farming for as long as necessary.

Example: A recent use of this strategy can be seen in AiRev’s approach to maximizing liquid staking points using Teller. AiRev borrowed 100 WETH against their long-term $PRIME holdings to secure quick liquidity, which was then deployed via Gearbox into the Renzo Protocol. This strategy boosted their EigenLayer points by 4.8x and Renzo points by 9.5x.

TLDR; Teller time-based loans have been used to maximize liquid staking points. Read the guide for a walkthrough of how AiRev achieved these results.

DeFi Cash Advances for Real Life Expenses

A Teller time-based loan offers access to instant capital, when needed, with the flexibility to repay on a set timeline.

This loan structure allows individuals to borrow USDC (USD Coin) and spend it directly through the HolyHeld debit card. Whether handling everyday expenses, funding a special project, or covering unexpected costs, this solution provides immediate financial capital, while offering the predictability of a time-based repayment schedule.

Example: Imagine a crypto holder’s car unexpectedly needs repair, but payday is still a week away. With a Teller time-based loan, the holder can borrow USDC, and use the HolyHeld debit card to cover the repair costs immediately. This allows the holder to get the car back on the road, without delay. The loan can be repaid according to the pre-set timeline, akin to typical credit card payments.

5 Easy Steps to Secure and Repay a Teller Time-Based Loan

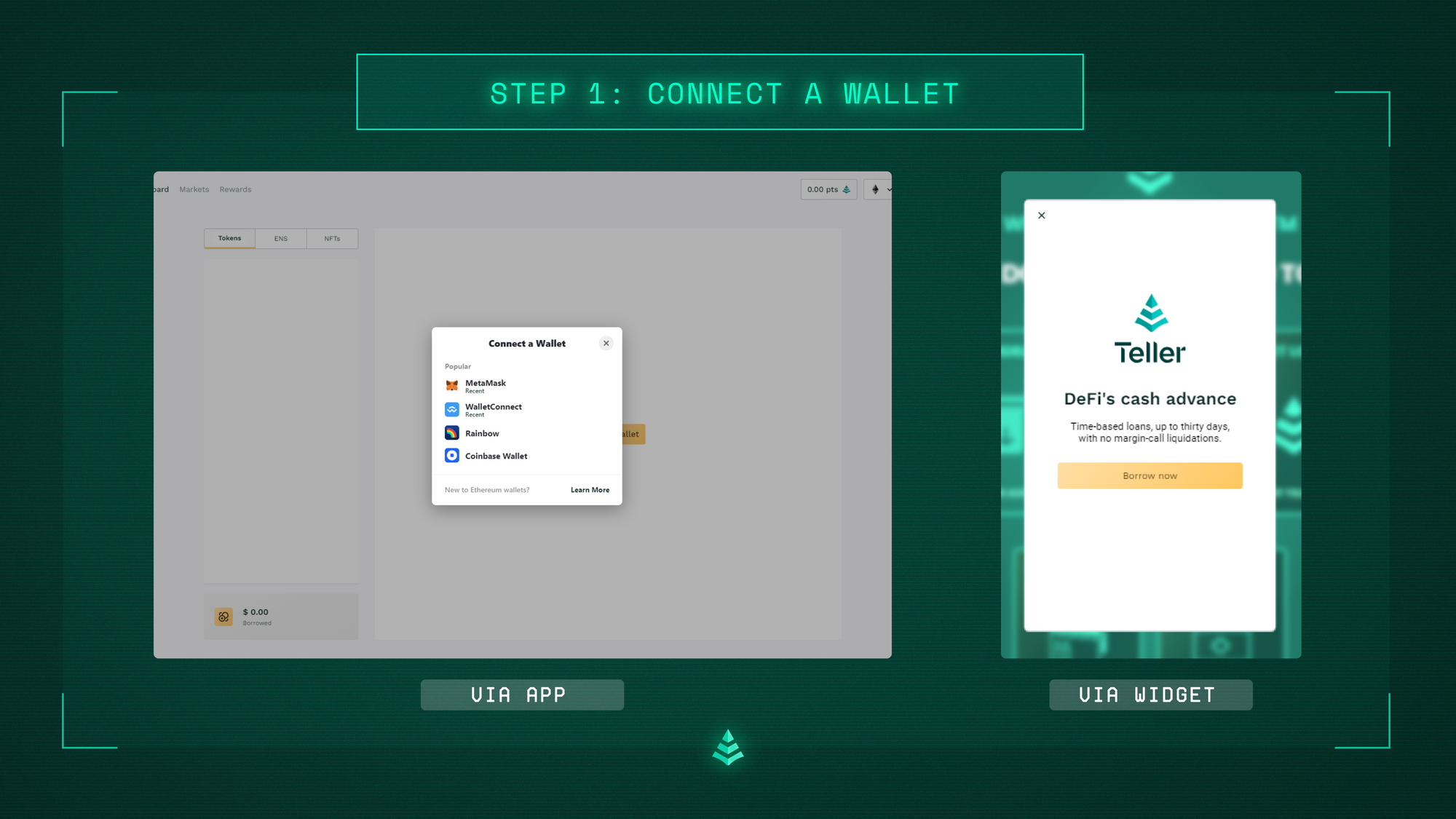

Step 1: Connect a Wallet

Connect a cryptocurrency wallet to the Teller platform using supported wallets like MetaMask, Coinbase Wallet, or others that support Web3 connections.

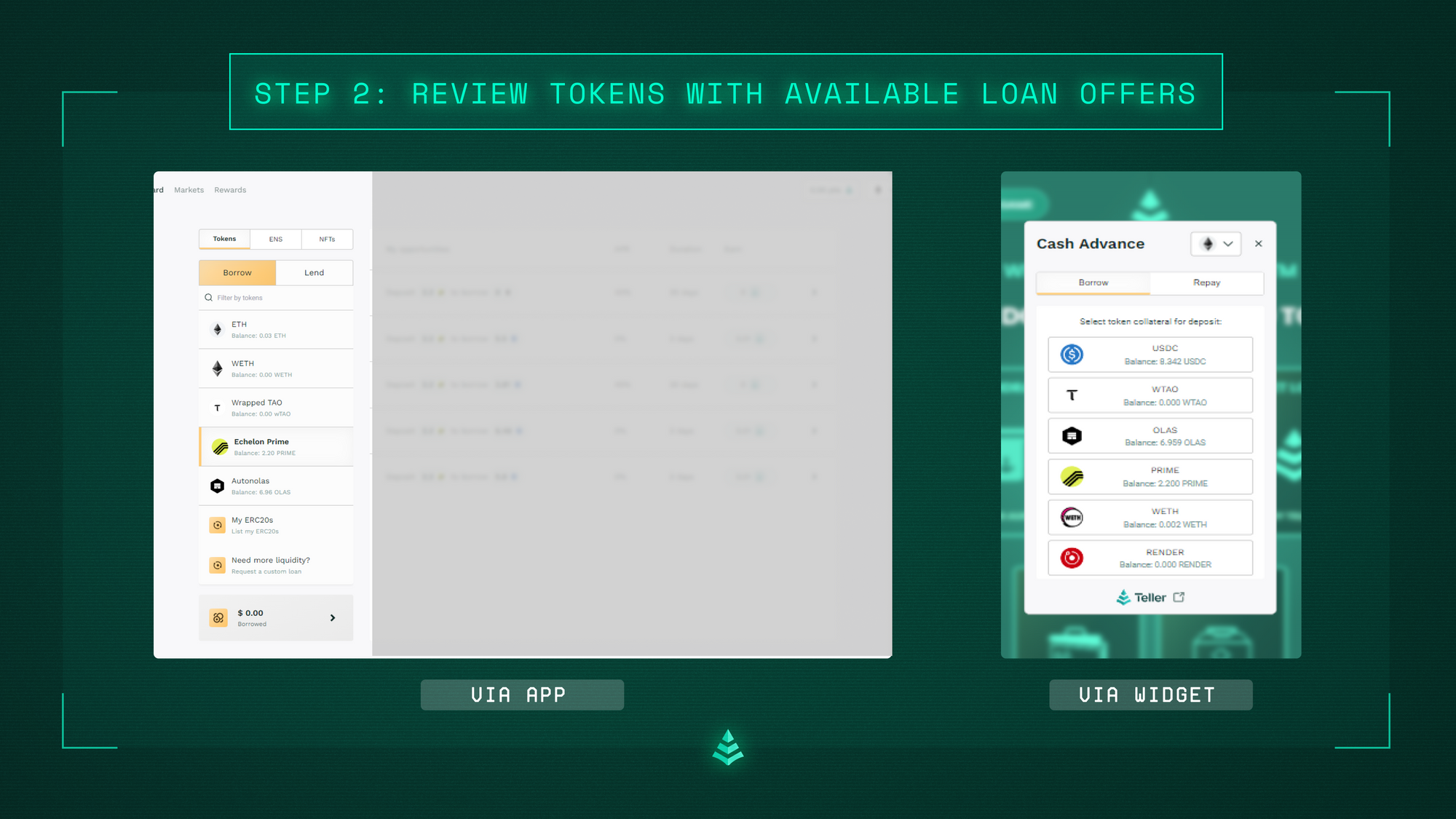

Step 2: Review Tokens with Available Loan Offers

View the tokens in the wallet that are eligible for loan offers. The Teller platform will display the available loan opportunities based on the tokens held .

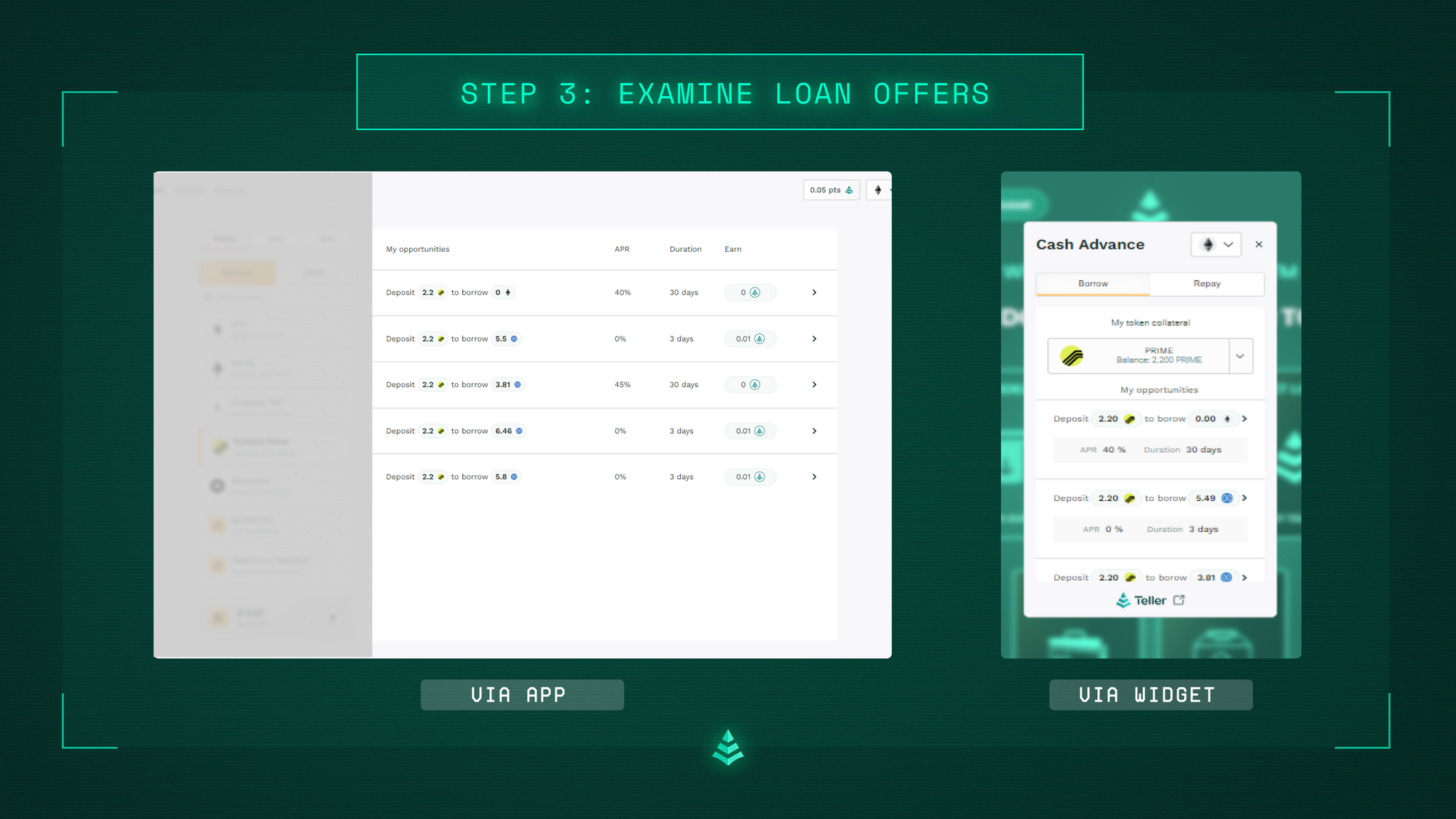

Step 3: Examine Loan Offers

Review the available loan offers for each eligible token. Offers vary based on:

- Loan-to-Value Ratio (LTV): The percentage of the token's value that can be borrowed.

- Annual Percentage Rate (APR): The interest rate applied to the loan.

- Duration: The length of time the loan is active.

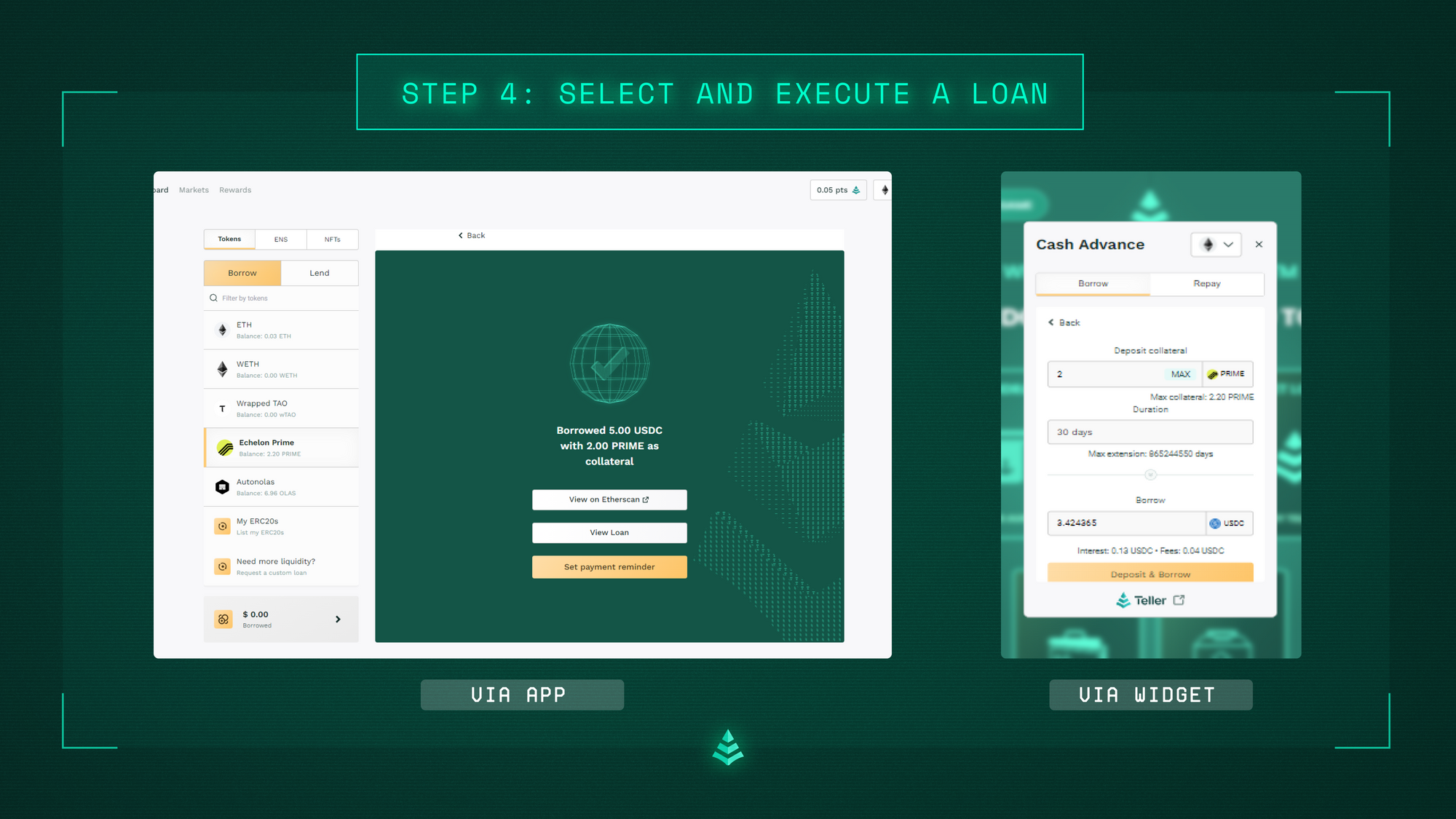

Step 4: Select and Execute a Loan

Choose a preferred loan offer and initiate the loan process in a single transaction:

- The chosen collateral (tokens) is moved into an on-chain escrow smart contract.

- The loan capital is transferred directly to the wallet.

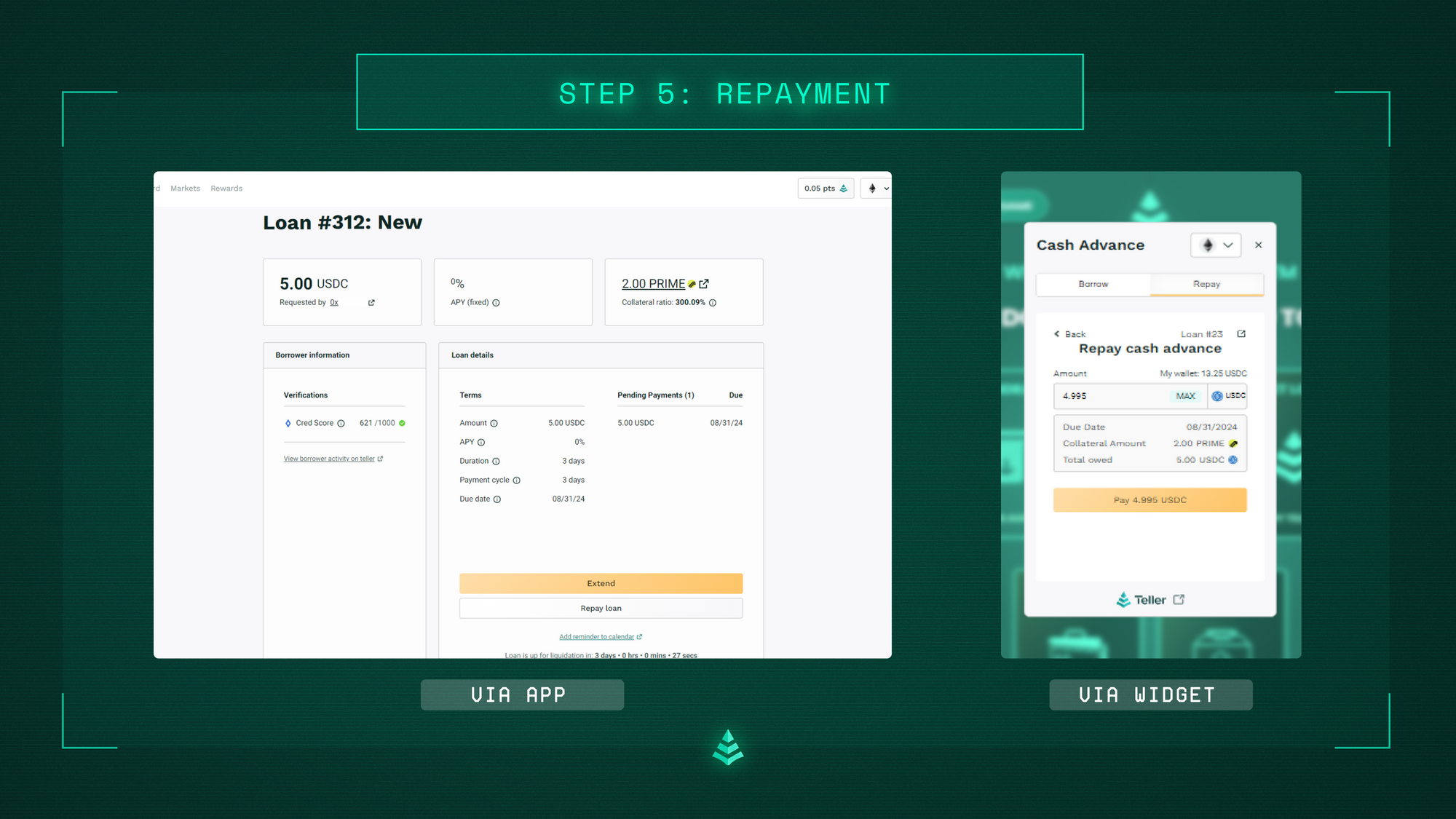

Step 5: Repayment

At the end of the loan duration, repay the loan along with any applicable fees to release collateral from the escrow smart contract.

Teller’s time-based loans open up a world of possibilities for those looking to optimize their DeFi strategies. Whether the goal is to stabilize a position, diversify a portfolio, maximize yield farming plays, or funds for personal expenses, Teller provides the liquidity solution needed.